Core Technology Drives Revenue Cycle Playbook at Henry Ford Health System

By Robin Damschroder, EVP & CFO and Steve Hathaway, SVP Finance & CRO, Henry Ford Health System

At Henry Ford Health System, our Revenue Cycle leadership with support of the Revenue Cycle Transformation Consulting and Analytics team, utilizes an annual playbook to drive performance improvement for hospital and employed physicians, emphasizing patient experience, yield optimization, and lowering cost-to-collect. Playbook typically contains 70-100 projects related to enhanced workflows, technology, and performance.

Our yield improvement initiatives have resulted in significant outcomes, including reducing preventable loss write-offs to 0.77%, raising residual self-pay collection rate to 65%, and improving risk scores by 31%. The improvements in these areas that we refer to as Revenue Cycle Classic have yielded cumulative gains of $572.6M through 2020. In recent years, Playbook programs have expanded beyond “Classic” into risk adjustment, value-based care and utilization management, reflecting industry trends shifting from pure fee-for-service payment models towards pay-for-value. The playbook is refreshed continuously, with a more thorough review and update on an annual basis. Playbook projects often span multiple years and a two-year Gantt model is maintained for tracking timelines.

For 2022, the playbook is incorporating a Mosaic methodology for the first time. Under this approach, Revenue Cycle is being thought of at a much more granular level than the usual front/middle/back model reflecting patient access, coding and documentation improvement, and business office. Planning is organized around 35 distinct functions, which include registration, insurance verification, authorization procurement, charge optimization, physician education, clinical documentation improvement, coding, billing, cash posting, and call center. For each of these functional areas, “tiles” have been developed to assess opportunities in the areas of yield, cost, productivity management, and technology. Additionally, for each of the 35 functions, a 10-year strategy has been created to plan for future Playbook content.

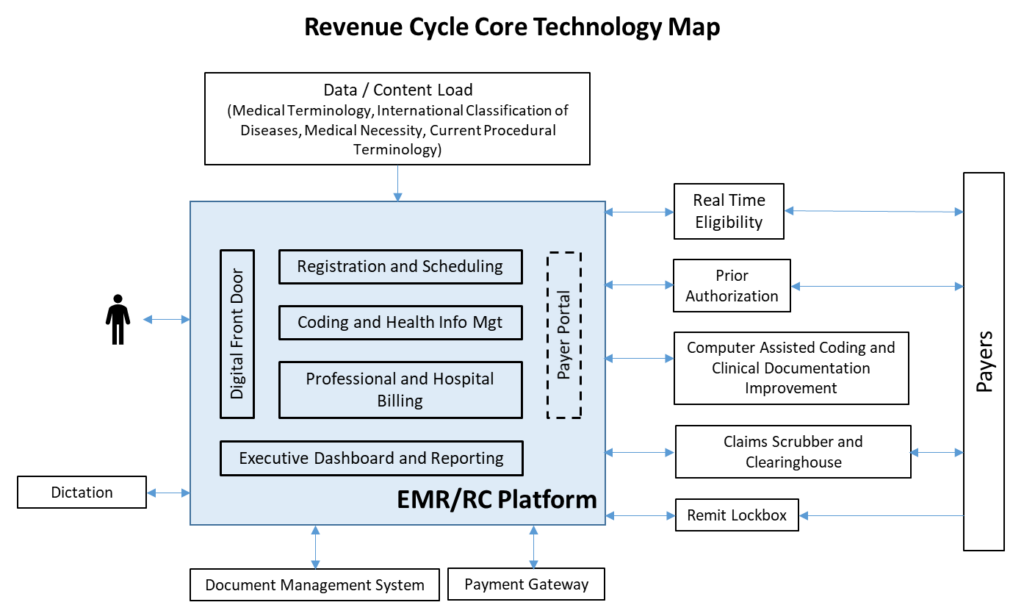

Common patterns are emerging within these Mosaic tiles, especially in automation, self-service patient experience, and payer connectivity. Technology deployment is the underpinning in almost all instances and will require forward-thinking to figure out how it will impact workflows and the patient/provider experience. However, predicting the top vendors and applications in this space after ten years from now is anyone’s guess.

Sifting through an array of innovative start-ups and development plans for scaled technology presents challenges between a provider’s short and long-term planning and aspirations for the future of revenue cycle. To that end, we’ve identified a few guiding principles that are enabling our organization to keep moving forward:

- Avoid paying twice for the same functionality. Because core technology providers are moving fast, gap analyses should be continuously performed to ensure that available features and functionality are deployed. Be aware of current and future capabilities. Core technology not only includes Revenue Cycle platforms such as EHR, but other major applications and services. It is important to assess each core application and how the platforms integrate.

- Consider the “Automation Hierarchy” in Technology Planning Efforts. Historical frameworks for how work is accomplished are no longer a viable option. Much like how early automobile designs emulated “horseless carriages” before departing into their own paradigm, automation that relies on existing workflows are transitional at best. Anthropomorphic models such as keyboard emulation vehicles underpinning Robotic Process Automation (RPA), high-volume screen-scraping of payer websites designed for human users and scanning will give way to higher-order automation such as core system optimization, direct payer connectivity, optimization of EDI data formats, and digitization of analytic material.

- Ensure a viable exit strategy when bridging core technology gaps with Best of Breed (BOB) point solutions. There is a place for filling Core Technology provider gaps with BOB solutions when done in the context of core provider development cycle knowledge. However, be open-minded when other options become available. Cost, integration with core systems, and “loss of fidelity” of core technology are drawbacks, as are the complexities of implementing and maintaining interfaces. Rely on your ROI analyses and negotiate wind-down strategies for when Core technology gaps close or other better options arise.

- Be wary of gain-sharing arrangements for technology. We all know that technology will continue to revolutionize the workplace and further erode human touches at the individual transaction level. Provider organizations will understandably rely on this to meet economic headwinds facing the healthcare industry. However, payments under these gain-sharing arrangements could be redeployed to relieve the pressure on direct patient care investment.

- Assess and categorize the Technology Provider landscape and timeline to deploy versus surveil continuum. Each Mosaic function presents a unique array of technology and technology partner options. In some cases, clear winners can be identified, and long-term partnerships can be pursued. Where technology approaches are more turbulent and emergent winners are unclear, consider a more cautious approach of utilizing short-term partnerships to achieve greater portability.

There is consensus that automation and other technology advances will radically change Revenue Cycle over the next decade, requiring discipline and a structured approach to enhance the patient experience and meet your financial goals. Having a clear understanding of your core system capabilities will put you on the right path forward.